The "Month-End Close" Bottleneck: Real-Time vs. Batch Processing

Why do some finance teams close the books in 5 days while others take 20? The answer isn't "working harder"—it's software architecture.

The "Month-End Close" is the ultimate stress test for any accounting system. In a traditional SMB setup (like QuickBooks Desktop or older legacy ERPs), the close is a Batch Process. You wait until the month ends, then you start a linear sequence of tasks: download bank statements, upload CSVs, run depreciation scripts, and post accruals.

This "Stop-and-Go" approach creates a massive bottleneck on Day 1 of the new month. Your team is buried in data entry just when they should be analyzing results.

The "Continuous Accounting" Shift

Modern cloud ERPs (like NetSuite and Sage Intacct) operate on a Continuous Accounting model. The goal is to distribute the workload evenly throughout the month, rather than compressing it into a frantic 5-day window.

This isn't just a process change; it requires specific software capabilities that "Batch" systems lack:

Automated Bank Feeds

Transactions are matched daily via API rules, not monthly via CSV upload. By Day 30, 95% of cash is already reconciled.

Dynamic Allocations

Overhead costs are allocated to departments automatically upon posting, eliminating the massive "Allocation Journal Entry" at month-end.

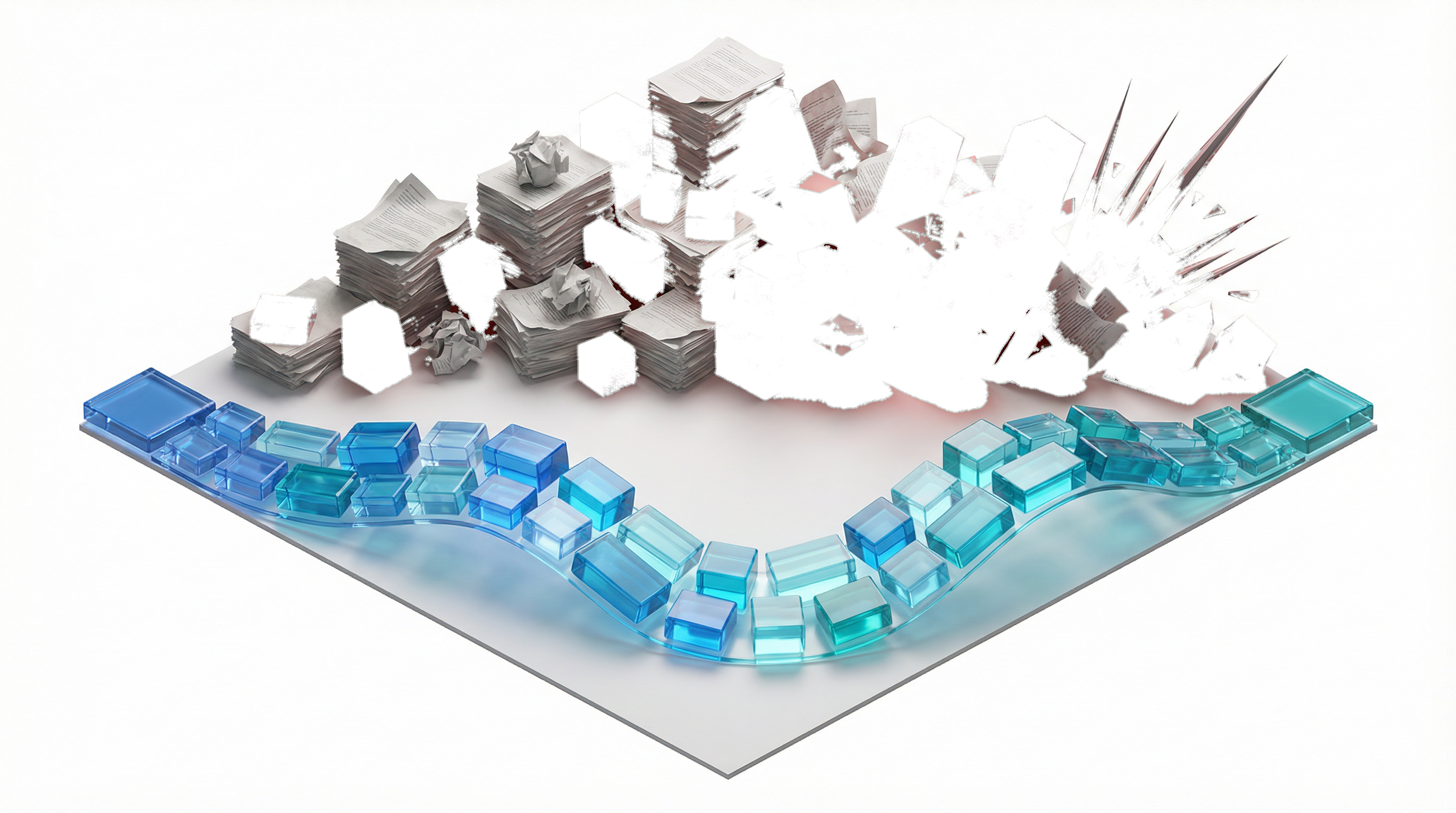

Visualizing the Timeline

The difference is stark when you map it out. In a Batch system, the "Work Line" spikes dramatically after month-end. In a Continuous system, the work is a flat line.

The Strategic Value of a Fast Close

Closing faster isn't just about letting your accountants go home early (though that helps retention). It's about Decision Latency.

If you close on Day 20, your management team is making decisions based on data that is 3 weeks old. If you close on Day 5, they are reacting to last month's reality while it's still fresh. In a high-growth SaaS company, that 15-day gap is the difference between pivoting a failed campaign and burning cash for another month.